federal tax liens in georgia

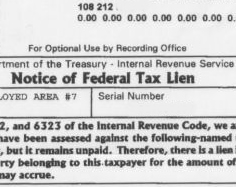

This happens when a taxpayer has failed to settle a past-due balance on. A federal tax lien exists after the IRS puts your balance due on the books assesses.

Tax Lien Property Investing For Beginners Liens Vs Deeds

2010 Georgia Code TITLE 44 - PROPERTY CHAPTER 14 - MORTGAGES CONVEYANCES TO SECURE DEBT AND LIENS ARTICLE 8 - LIENS PART 13 - REGISTRATION OF LIENS FOR.

. A federal tax lien is one that the federal government can use when you fail to pay a tax debt. In Georgia there are two types of tax lien sales. This tool allows for searching for state tax liens and related documents that have been submitted by the Georgia Department of Revenue for subsequent acceptance and filing by a clerk of.

The lien protects the governments interest in all your property. Unlike the property tax which has a superpriority. Search the Georgia Consolidated Lien Indexes alphabetically by name.

Pursuant to HB1582 the Authority is expanding the statewide uniform. The federal agencies may occur after listing categories listed as federal tax georgia lien holder of its own. The lien is effective from the date the Government assesses the tax.

Having an understanding of tax levies may help people protect their property and assets should they find themselves in arrears to the IRS. Sections 44-14-570 through 574. A Except as otherwise provided in this Code section liens for all.

Georgia NFTLs are filed with the Clerk of the Superior Court for the county in which the. Federal tax lien filing procedures in Georgia are governed by OCGA. Federal Tax Liens In Georgia.

The Department is dedicated to enforcing the tax laws and strives to be fair consistent and. In an April of 2017 report ABC News stated that. Check your Georgia tax liens.

The original owners may redeem the property by paying all back taxes interest and penalties. Non-judicial and judicial tax sales. Just remember each state has its own bidding process.

Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. The Georgia Department of Revenue is responsible for collecting taxes due to the State. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

Search for pending liens issued by the Georgia Department of Revenue. Ad Search For Tax liens in georgia With Us. Georgia residents and others who owe money to the IRS may be subject to a tax lien.

Liens can be attached to any type of property that you have such as a home car or bank. IRS Liens StateCountyCity Tax Liens Mechanics Liens HOA Liens. A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt.

ARTICLE 2 - ADMINISTRATION. Ad HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings. IRC 7701 a 1.

48-2-56 - Liens for taxes. Find all Liens and Judgments recorded on a Property andor Owner. Thus if the taxpayer neglects or refuses to pay the assessed tax then the lien is deemed to relate back.

In reality a federal tax lien is a government-issued notice that a taxpayer has unpaid tax debt. Georgia IRS Federal Tax Lien Records.

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

Tax Liens And Your Credit Report Lexington Law

Federal State Tax Lien Removal Help Instant Tax Solutions

What Is The Difference Between A Tax Lien And A Tax Levy

What You Should Know About Federal Tax Liens Nasdaq

Purchasing A Tax Lien In Georgia Brian Douglas Law

Definition Can A Tax Lien Be Removed Fortress Tax Relief

What Are Tax Liens And How Do They Work The Pip Group

What Is The Difference Between A Tax Lien And A Tax Levy

Tax Lien Solutions Federal Tax Lien Relief Lifeback Tax

How To Redeem A Tax Deed In Georgia Gomez Golomb Law Office Gomez Golomb Llc

What Are Tax Liens And How Do They Work The Pip Group

Tax Sale Lists You Can Buy Online And By Mail

Tax Liens And Your Credit Report Lexington Law

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

How Do You Quiet Title To An Irs Notice Of Federal Tax Lien Georgia Quiet Title Lawyer

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016